What You Should Know:

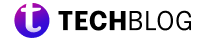

– After a strong start to the year, the digital health sector experienced a significant pullback in Q2 2025, with deal volume declining to its lowest quarterly activity level in the last five years, according to the latest report from Silicon Valley Bank (SVB).

– The report, Mid-Year Healthcare Investment and Exits Report reveals growing investor selectivity and capital concentration in fewer, high-conviction bets amidst ongoing global economic uncertainty. Despite the contraction in the broader sector, AI continued to dominate funding, and two established companies achieved $1B+ valuations upon going public.

Digital Health Funding Falls as Deal Volume Hits 5-Year Low

Digital health equity funding experienced a 21% quarter-over-quarter (QoQ) drop in Q2 2025, falling to $4.4B. Deal count also declined to 267 from 325 in Q1 2025, marking the lowest quarterly total in the last five years, according to CB Insights data. This pullback follows a robust Q1 and mirrors the broader venture landscape, where deal activity reached its lowest level since 2016.

Despite the overall pullback, Q2 produced two new unicorns this quarter:

- Pathos: An AI-driven oncology drug developer, achieved unicorn status after raising a $365M Series D round, one of the largest digital health funding rounds of the quarter.

- Nourish: A telenutrition platform, also reached unicorn status after securing its $70M Series B round.

The funding landscape this quarter shows a clear preference for more mature companies. While early-stage rounds averaged $7.7M in Q2 (down from $11.7 million in Q1), late-stage deals averaged $137M, a 69% increase from the prior quarter. This rise was powered by a few significant raises, most notably Elon Musk co-founded Neuralink’s $650M Series E round, the largest digital health deal since 2021, which will advance the company’s AI-powered brain-computer interface platform.

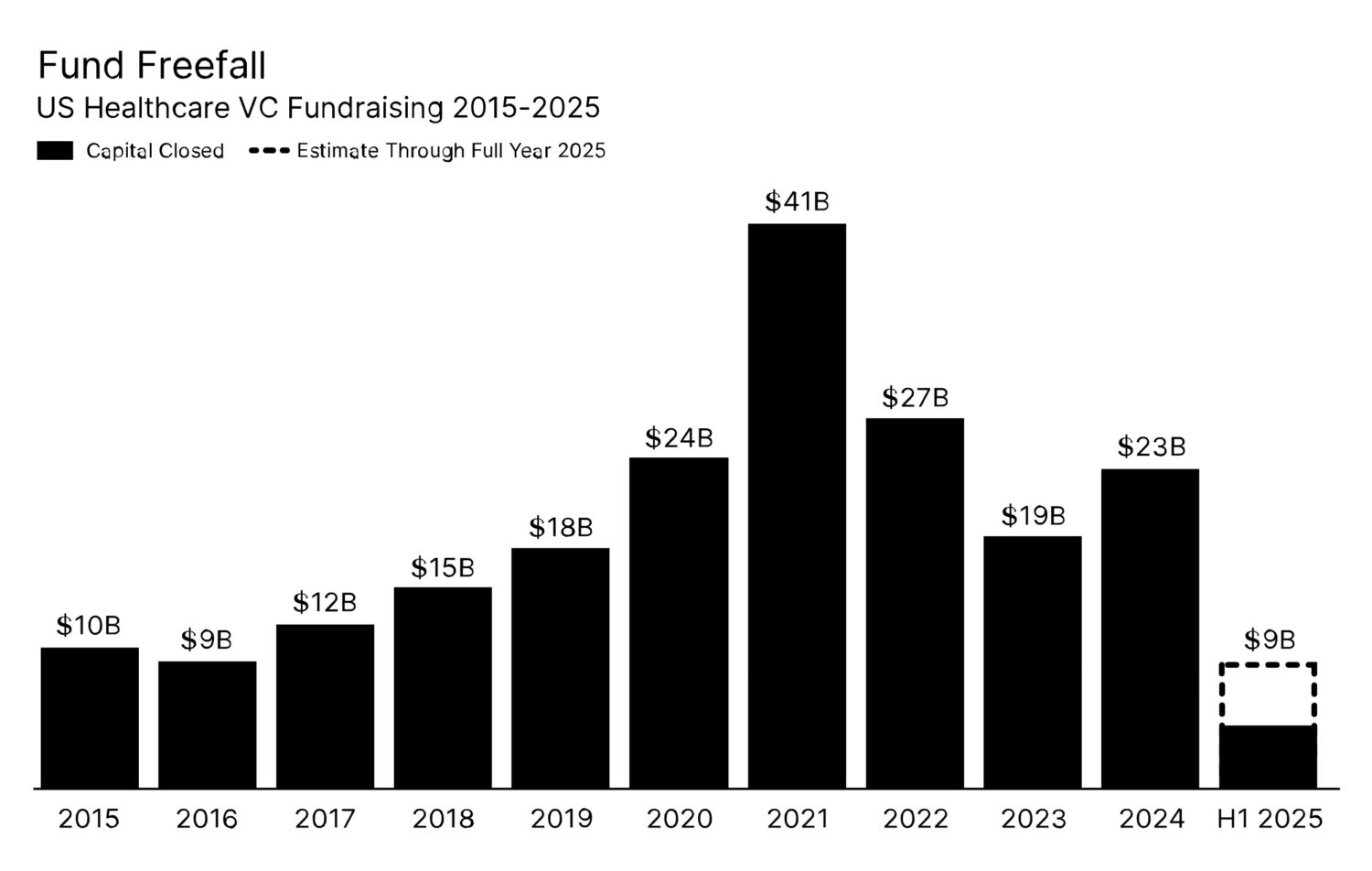

AI Companies Capture More Than Two-Thirds of Digital Health Funding

AI continues to be the dominant force in digital health investment. AI-focused companies captured an impressive 69% of all digital health funding in Q2 2025, up from 60% in Q1, while their deal share held steady at 41%. Notably, AI companies claimed 9 of the 10 largest deals this quarter, including 6 of the 7 mega-rounds (fundraises of $100M or more).

AI-driven investments spanned multiple high-impact markets in Q2:

- Medical Brain-Computer Interface (BCI): This was the highest-funded market in digital health, driven solely by Neuralink’s $650M Series E round.

- Clinical Documentation Solutions: This market was the second highest-funded, attracting $639M across 5 deals. Key companies in this space include Abridge ($300M), Commure ($200M), and Nabla ($70M), all focused on AI-powered clinical note-taking tools. All three boast strong CB Insights Mosaic scores above 900.

Additionally, AI adoption is focused on reducing administrative burden rather than clinical tasks, accounting for 44% of all AI investment in 1H 2025.

Two Digital Health Companies Go Public with $1B+ Valuations

Digital health saw its first significant IPO activity in over a year, signaling a potential thawing of the public markets. Hinge Health and Omada Health debuted in Q2 2025 at valuations of $2.6B and $1.1B, respectively. These are the first digital health IPOs to surpass the $1B mark in the last four quarters.

Both companies offer employer-driven chronic care programs, betting on access to commercially insured patients to attract payers seeking cost savings.

- Hinge Health: Provides musculoskeletal therapy programs to employers and health plans, combining virtual physical therapy, motion tracking, and personalized coaching. It raised $854M across 12 rounds before its IPO.

- Omada Health: Targets chronic conditions like diabetes, hypertension, and obesity through its AI-enhanced virtual care platform, which introduced a nutrition-focused AI agent this year. It raised $530M over 14 rounds before its IPO.

These IPOs break a multi-year drought, during which digital health companies delayed going public amid market volatility. As two of the sector’s most mature startups, their successful exits may serve as bellwethers for the broader industry.

Sector-Specific Investment Trends

- Biopharma: Late-stage companies show favor, with median biopharma pre-money valuations among Series C+ hitting $247M in 1H 2025, significantly higher than Series A ($46M) and Series B ($87M) startups.

- Healthtech: This sector remains strong, raising a total of $8.2B in 1H 2025, making it the strongest half since 1H 2022. Series B deal size jumped to $40M, a five-year high.

- Dx/Tools: Despite a slowing market, early-stage diagnostics and tools companies show silver linings, with Series A median pre-money valuations and deal sizes reaching a five-year high at $38M and $14M, respectively.

- Medical Device: Device investment proves consistent, totaling between $3B and $4B every half since 2022. However, macroeconomic events like tariffs could cause a veer off course, as device companies appear likely to be most impacted by such policies.

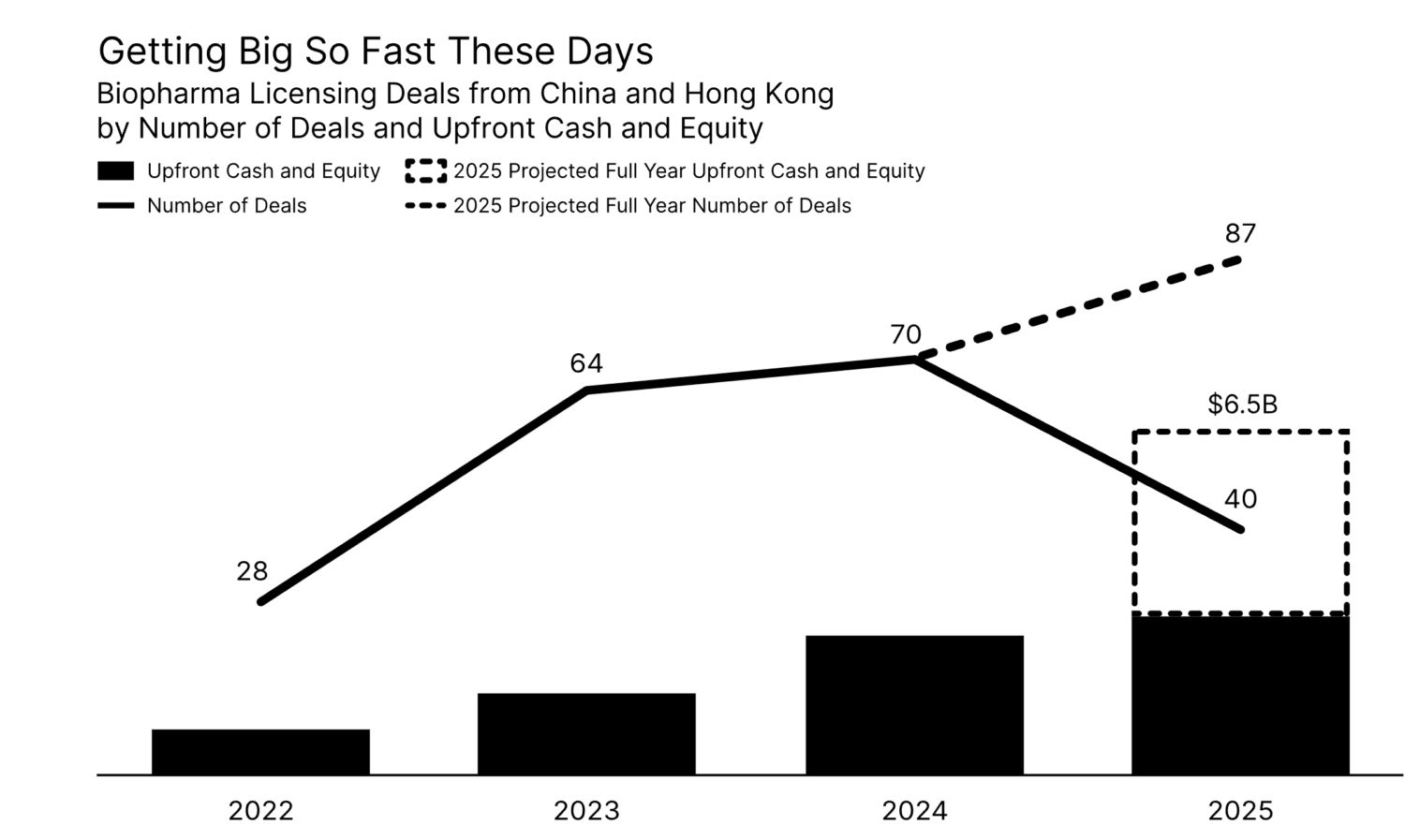

China’s Growing Influence in Biotech

China has established itself as a force in global biotech, benefiting from structural advantages in cost, development speed, and regulatory efficiency. In 1H 2025, total spending on Chinese biopharma licensing deals reached $3 billion, already surpassing the total spent in all of 2024.

For more information, visit